(With inputs from Dipali Banka and Christina Moniz)

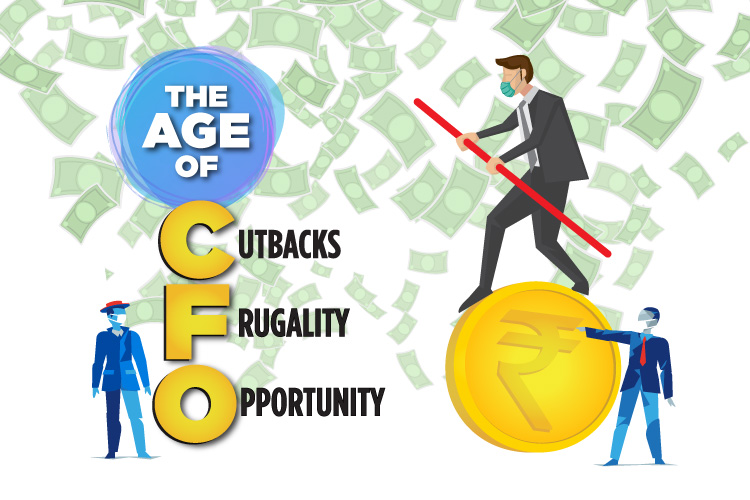

From Steve Jobs to Jeff Bezos, we have witnessed decades of chief executive officers in the bright spotlight. But not so much the humble chief finance officers (CFOs) - risk-averse and traditionally conservative, the CFO has stayed out of the limelight, until now. As the COVID-19 crisis leaves businesses across sectors in a constant seismic flux, leading to massive financial fallouts, company CFOs are increasingly stepping into the spotlight as balance sheets are under immense scrutiny. As a member of the executive who is both a financial expert and a strategic thinker, the moves of CFOs within companies, and outside as well, will signal the road ahead. The CFOs of the new world are expected to de-risk business and adapt to the changing environment. Their roles have extended to manage not just the fiscal aspects but also the business/operational aspects of the company in the face of the pandemic.

Several companies understand the importance of the CFO role and have made various leadership changes. Some recent appointments and transitions say a thing or two about the significance of the role of CFO in an attempt to weather this storm.

As the CFO role takes centre-stage, we speak to the power players from the media and advertising agency space to find out how organisations are implementing an immediate crisis response mechanism while exploring long term sustainability solutions to build resilience against this black swan event.

SHINING THROUGH THE STORMS

The humanitarian and economic crisis might have resulted in high volatility in financial markets, dried up liquidity and economic slowdown around the world, however CFOs across sectors are not letting these challenges dampen their spirits as they use this as a time to come up with innovative solutions to the constraints.

Inigo Franco, Country Finance Director, WPP India reveals that the group’s Q1RF has been revised downwards with double digit decrease in revenue, net sales and OP owing to the economic crisis caused by the COVID-19 pandemic. However, he adds that the company is keeping people at the centre of decisions and using the situation to accelerate transformation. “For instance, we are focusing our energies towards new ways of working, new propositions, agile organizations and right sizing. It is definitely a challenging time but one that has forced us to move and transform faster. Our campus strategy is paying off – in Mumbai we are able to materialize savings and as the Gurgaon campus is in the making, it has provided us the opportunity to rethink our office space from the ‘traditional’ into a ‘meet, greet and collaborate’ - increased agility across our people + brands,” Franco remarks.

Balkishan Sahni, Finance Director, MediaCom, says that the COVID-19 crisis has very strongly impacted the agency’s financial plan by putting a brutal halt to advertising spends across all mediums. Sahni indicates that one full quarter is almost wiped out from the year. “Except a few advertisers who are offering essential products, the entire advertising ecosystem has been put under pressure. The focus is to keep working closely with clients to help them optimize their ad spends and look for maximum value for their spends,” he says. Sahni, however, stresses that the company is working towards returning to normal as soon as the lockdown ends. “Certain practices developed and adopted during this period will become the new normal. Use of technology will increase and ability to stay connected remotely remains important as travel is unlikely to resume soon,” he explains.

Balkishan Sahni, Finance Director, MediaCom, says that the COVID-19 crisis has very strongly impacted the agency’s financial plan by putting a brutal halt to advertising spends across all mediums. Sahni indicates that one full quarter is almost wiped out from the year. “Except a few advertisers who are offering essential products, the entire advertising ecosystem has been put under pressure. The focus is to keep working closely with clients to help them optimize their ad spends and look for maximum value for their spends,” he says. Sahni, however, stresses that the company is working towards returning to normal as soon as the lockdown ends. “Certain practices developed and adopted during this period will become the new normal. Use of technology will increase and ability to stay connected remotely remains important as travel is unlikely to resume soon,” he explains.

While finance professionals are used to accuracy, consistency and relatively predictable planning cycles, how do they plan in an environment of unclear economic conditions and time horizons of a global pandemic of this stature? Well, as the going gets tough, the tough get going, evidently.

C Suresh, Group CFO, FCB India shares that the agency is reimagining the business by eliminating or fixing broken processes. “When the oceans are choppy and dangerous for fishing, fishermen repair their nets. We are taking a look at all our processes with a view to eliminating wastage and optimising productivity,” he points out.

C Suresh, Group CFO, FCB India shares that the agency is reimagining the business by eliminating or fixing broken processes. “When the oceans are choppy and dangerous for fishing, fishermen repair their nets. We are taking a look at all our processes with a view to eliminating wastage and optimising productivity,” he points out.

Meanwhile, Asha Suvarna, CFO, Dentsu Aegis Network India reveals that the agency group has created specialized teams to assess the dynamic situation and plan accordingly. “Due to well tested BCP and technology in place at DAN and excellent team connectivity, our work standard remains uncompromised. Though this is a difficult time, we are prepared and confident to manage the crisis in a well-organized manner by efficient forecasting, close tracking and liquidity management,” she asserts.

Meanwhile, Asha Suvarna, CFO, Dentsu Aegis Network India reveals that the agency group has created specialized teams to assess the dynamic situation and plan accordingly. “Due to well tested BCP and technology in place at DAN and excellent team connectivity, our work standard remains uncompromised. Though this is a difficult time, we are prepared and confident to manage the crisis in a well-organized manner by efficient forecasting, close tracking and liquidity management,” she asserts.

THE CASH ROOM WAR

Challenges around liquidity and credit continue to remain an area that agencies are forced to grapple with as the situation evolves. As Bhautik Mithani, Chief Financial Officer, Wunderman Thompson, South Asia signals, in these unprecedented times, the most important function that the CFO has to perform is to keep a hawk’s eye on cash flows. “It’s imperative to ensure that there is adequate cash flow in the form of working capital to keep the company running. Focus needs to be on collections from clients, tax refunds, old overdue outstandings from clients, etc. We have been continuously in touch with our clients to work out a win-win situation for both in terms of cash flows,” he reveals.

Challenges around liquidity and credit continue to remain an area that agencies are forced to grapple with as the situation evolves. As Bhautik Mithani, Chief Financial Officer, Wunderman Thompson, South Asia signals, in these unprecedented times, the most important function that the CFO has to perform is to keep a hawk’s eye on cash flows. “It’s imperative to ensure that there is adequate cash flow in the form of working capital to keep the company running. Focus needs to be on collections from clients, tax refunds, old overdue outstandings from clients, etc. We have been continuously in touch with our clients to work out a win-win situation for both in terms of cash flows,” he reveals.

Recently, the president of the Advertising Agencies Association of India, Ashish Bhasin sent a detailed set of recommendations on behalf of the members of the organisation, to the Union Minister of Information and Broadcasting, Prakash Javadekar, highlighting how cash flows are under stress and how many businesses in the advertising industry will either file for bankruptcy or will have to undersize considerably, if nothing is done about it. In the letter, he requested that the money that is owed to the advertising industry by way of IT and GST refunds, and dues from Government and PSUs for advertising bills, be settled immediately. Moreover, he urged that any payment made to agencies should not suffer any TDS deduction going forward, since there is unlikely to be any significant profit for the year. Bhasin also spoke about seeking a direction to banks and debtors to provide the much-needed cash flow to pay salaries and meet other essential expenses.

Recently, the president of the Advertising Agencies Association of India, Ashish Bhasin sent a detailed set of recommendations on behalf of the members of the organisation, to the Union Minister of Information and Broadcasting, Prakash Javadekar, highlighting how cash flows are under stress and how many businesses in the advertising industry will either file for bankruptcy or will have to undersize considerably, if nothing is done about it. In the letter, he requested that the money that is owed to the advertising industry by way of IT and GST refunds, and dues from Government and PSUs for advertising bills, be settled immediately. Moreover, he urged that any payment made to agencies should not suffer any TDS deduction going forward, since there is unlikely to be any significant profit for the year. Bhasin also spoke about seeking a direction to banks and debtors to provide the much-needed cash flow to pay salaries and meet other essential expenses.

Anurag Bansal, CFO, DDB Mudra Group observes that agencies are staring at rapid deterioration in revenue, something that calls for costs to be curtailed pre-emptively and adequately. “Liquidity and credit are big challenges. Companies are working hard to salvage business, reinvent, improvise their offerings and control costs to stay profitable, and in some cases even survive. The most important task is to preserve cash and manage working capital. The cliché ‘cash is king’ has never been truer. Sustainability and viability of the company must be the guiding principle for any decisions taken today,” he opines.

Anurag Bansal, CFO, DDB Mudra Group observes that agencies are staring at rapid deterioration in revenue, something that calls for costs to be curtailed pre-emptively and adequately. “Liquidity and credit are big challenges. Companies are working hard to salvage business, reinvent, improvise their offerings and control costs to stay profitable, and in some cases even survive. The most important task is to preserve cash and manage working capital. The cliché ‘cash is king’ has never been truer. Sustainability and viability of the company must be the guiding principle for any decisions taken today,” he opines.

DAN’s Suvarna shares that the agency has undertaken relatively short term financial planning for better implementation and tracking perspective. “As of now, India’s economic growth is estimated to be at an all-time low in the last six years at 5.3- 5.7% in anticipation of quick recovery and may further decline to 3.5% subject to the success of containment measures taken by the Government and extent of proliferation of the virus. In this situation, cash flow management has taken centre-stage as liquidity gives confidence and stability in business. We are taking all possible cash conservation measures and have also temporarily implemented a cost reduction plan. All the measures are being taken keeping in mind the larger interest of our people,” she contends.

Meanwhile, in the media, players in the Print and TV space are slightly less affected than the rest due to their subscription-based business models and some advertising revenue. Add to this the fact that the captive audience has been gravitating to these mediums as their sources of news, information and entertainment. However, drying up of advertising spends remains a big concern. “We are tackling the situation by cutting the requirement of liquidity and augmenting liquidity,” says RK Agarwal, CFO, Jagran Prakashan.

OF INVESTMENTS AND INNOVATIONS

When a CFO wants his company to thrive in in the aftermath of a debilitating economic crisis, he or she has to prepare for a transformation mindset while allocating the company resources - something that most companies seem to be gravitating towards. How are they strengthening their ability to survive through ‘the next normal’?

Interestingly, in these uncertain times, Kamal Mandal, CFO, Famous Innovations is guiding his agency towards an investor mindset, deciding how much the agency can put behind acquiring the right partners and the right people – be it technology, more diverse creative talent or new geographies. “Everyone will tell you that this is the time for conservation. Reduce all possible frill expenditures and create contingencies. But, there are also smaller companies out there who may need backing at this time. This is not the time to let talented entrepreneurs and people with great potential die down, and if there’s anything we can do to help that, we will. We are perhaps the only agency of our size that has hired a dozen people during the crisis,” Mandal asserts.

Interestingly, in these uncertain times, Kamal Mandal, CFO, Famous Innovations is guiding his agency towards an investor mindset, deciding how much the agency can put behind acquiring the right partners and the right people – be it technology, more diverse creative talent or new geographies. “Everyone will tell you that this is the time for conservation. Reduce all possible frill expenditures and create contingencies. But, there are also smaller companies out there who may need backing at this time. This is not the time to let talented entrepreneurs and people with great potential die down, and if there’s anything we can do to help that, we will. We are perhaps the only agency of our size that has hired a dozen people during the crisis,” Mandal asserts.

Most companies seem to be leveraging this time to re-energize their core capabilities to enable their organizations to make bold moves in the recovery phase. “I believe an organisation cannot shrink to greatness. If companies come back strongly after a crisis, they need to have protected and strengthened their core. I have made funds available to the agency to invest in consumer behaviour tracking research in these financially challenging times. An investment that, I believe, will empower us to bounce back quickly when this lockdown eases,” FCB India’s Suresh remarks.

Meanwhile Rishit Mehta, Finance Director, BBH India shares that the agency is leveraging a real-time P&L model to plan better. “The novel coronavirus has hit all organizations across sectors like a tsunami leading to a severe unprecedented existential crisis. We have moved to a Real-Time P&L model which enables live tracking of client revenue and overall profitability, short term revenue forecasting (STF) and analysis with overall target. It helps us to do weekly P&L monitoring vs a monthly one,” he shares.

Meanwhile Rishit Mehta, Finance Director, BBH India shares that the agency is leveraging a real-time P&L model to plan better. “The novel coronavirus has hit all organizations across sectors like a tsunami leading to a severe unprecedented existential crisis. We have moved to a Real-Time P&L model which enables live tracking of client revenue and overall profitability, short term revenue forecasting (STF) and analysis with overall target. It helps us to do weekly P&L monitoring vs a monthly one,” he shares.

CUTBACKS, COST OPTIMIZATION

Several agencies have implemented a series of cost optimization/ cost-cutting measures to sail through the uncertain times. “We are partnering with clients by finding the right balance between scope revisions and fee reductions in a mutually acceptable manner. Other measures we have implemented at BBH India include: office lease rental waiver, securing a rent holiday of at least another two months for both offices, no new recruits, replacements, and freelancers for the next three months , curbing all other discretionary spending, as well as client collections with extensive focus on collecting overdues led by business directors, daily follow-ups and routine reminders to the client

by the collections team and re-negotiating payment and credit terms with vendor partners from 60 days to 90 days, no production advances until receipt of funds from the client, etc,” Mehta states.

WPP-owned media agency MediaCom, too, is focusing on curtailing cost from all possible avenues with all discretionary expenses being put on hold. According to him, costs like travel, award entries, training, research, and use of freelancers have been frozen for the balance year. “There is a hiring freeze across the board and efforts are to optimize with the available staff. We are also analyzing avenues to rationalize cost on real estate and

IT spends to the optimum levels,” Sahni says.

To add to this, agencies are constantly building prediction models and forecasts to evaluate the potential impact of the pandemic on business in a bid to battle the cloud of uncertainty that the scenario has brought in. “To stay ahead of uncertainties, action plans are being developed to position our team for shifting strategic and financial decisions based on varied outcomes. This includes updating revenue estimates and implementing corresponding cost rationalisation measures, balancing short term financial commitments against long-term stability to determine which expenditures can be stopped or deferred. It is a difficult balancing act between the need for short-term cost actions against keeping the business ready to take advantage of likely growth opportunities post COVID-19,” Wunderman Thompson’s Mithani says.

Further, FCB India’s Group CFO indicates that the uncertainty around the easing of the lockdown phase makes it critical for companies to work towards multi-scenario planning in order to prepare the organisation for every eventuality. “It’s imperative to restore stability by focusing on preserving cash and preparing for every eventuality through multi-scenario planning. Cash is king and maintaining liquidity is critical in this time of crisis,” Suresh remarks.

FROM ‘SMART’ TO ‘HEART’

Gone are the days when a CFO’s role was traditionally centred around cost and compliance. It is now expanding to not just strategy and vision, but also to being a team-player that reaches beyond numbers and exhibits empathy, to chart a clear course for his team.

On such tough days, when employees may be struggling with health issues, anxiety or financial concerns, DDB Mudra Group’s Bansal feels that an empathetic approach in dealing with employees is critical. “This is where the culture at DDB Mudra Group comes forth strongly. Empathy is a fundamental part of our workplace social awareness and acts as a safeguard for ethical decision-making in these trying times without undermining organizational effectiveness,” he remarks.

Mandal, too, pronounces that it all boils down to honest and transparent communication. “While everyone across the organization has fear and speculation, only the CFO has accurate answers. Only the CFO knows the real water levels. So CFOs should look at the books carefully and give an honest assessment to the leadership, and then to the whole company. Being aware and reassured means people are in a better mental state, leading to better results. Someone recently said to me: in tough times there are smart companies and then there are heart companies. And that stuck with me. The CFO’s role may be the one most devoid of emotion most of the time. But this is the time to make an exception. Care for your people, your partners, your vendors and your clients. Allow the leeway you can afford, be generous where you can and remember that money will come back, people won’t,” he declares.

The message is clear: chief financial officers need to adopt bounded optimism to deal with the rising concerns around cash crunch and financial insecurity at every level in

the company.

A FUNCTION IN TRANSITION

5 things added to a CFO’s growing mandate

- TAKE CHARGE OF COVID-19 SITUATION: CFOs are now working closely with business leaders to continuously monitor the impact of COVID-19 on their organization and ways to navigate their way out of the crisis. They need to create a range of scenarios in these uncertain times and take control of things, as the focus shifts to optimizing cash flow and looking for optimization of cost structure.

- BE A STRATEGIC PLAYER: CFOs today need to break away from the number-cruncher stereotype and be a more strategic player in the company. They now need to think not just financially but also be creative, understand best practices and know how to create value for the company. Today’s CFOs are effectively business partners to CEOs, who guide and influence decision-making using the financial context.

- LEAD BY EXAMPLE: The role of a CFO to lead and communicate in such situations is imperative. They must be able to give advice and counsel as well as provide a voice of reason. Moreover, they must be able to translate detailed information to clear, concise and accessible messaging and give out clear answers to the questions in the minds of employees.

- EMBRACE TECH ADVANCES: Today, there are a wide range of tools that can help CFOs benefit from big data and the digitization of finance processes; for example, software that automatically complete repeatable, standardized, or logical tasks, such as processing transactions or integrating data to derive business insights. CFOs should increasingly use such tools to lead complex enterprise-resource planning efforts, among other challenges that they are being tasked with managing.

- REINVENT, INNOVATE: In this VUCA world, CFOs should be able to reinvent their organisation from the ground-up if the scenario demands. The new world might call for a totally new business model. As a finance chief, a CFO has the leadership skills, the financial expertise, the strategic thinking and the operational aptitude to guide the company through a once-in-a-career renaissance.

‘Business transformation has been accelerated’

“It will be a rough year, a sudden transformation has been put on agencies and clients alike – it was not asked for, it just arrived. There are going to be clear winners and losers, and those who manage to remain relevant and reinvent themselves will be ahead of the game. The business transformation has been accelerated and I remain positive that the actions that we take now will help us to land in a fairly good place once we are on the other side…”

“It will be a rough year, a sudden transformation has been put on agencies and clients alike – it was not asked for, it just arrived. There are going to be clear winners and losers, and those who manage to remain relevant and reinvent themselves will be ahead of the game. The business transformation has been accelerated and I remain positive that the actions that we take now will help us to land in a fairly good place once we are on the other side…”

Inigo Franco

Country Finance Director, WPP India

TELEVISION

‘WE’LL REJIG PRODUCTIVITY EXPECTATION FROM EVERY RESOURCE DEPLOYED BY THE BUSINESS’

S Sundaram, Group CFO, Republic Media Network says the focus is on helping customers see value in exposing their brands to the audience for the company’s services

Q] How has COVID-19 impacted your annual financial plan and what changes have you made in terms of strategy?

Q] How has COVID-19 impacted your annual financial plan and what changes have you made in terms of strategy?

COVID-19 will alter almost all annual financial plans. One advantage for TV news, with the lockdown having kept more people indoors, is that they have gravitated to looking for updates on current affairs in a big way. There’s a remarkable spurt in TV news consumption in this period. The challenge we have is the drying up of advertiser spends and hence the urgency to take our concept to new takers and to convert their preferences. With businesses coming to a grinding halt, the oft-repeated truism is heard loud and clear - in difficult times, businesses are prone to axe advertisement spends first. As an organisation, we are focused on customer reach-out and identifying avenues to help our customers see value in exposing their brands to the ever exploding audience for our services.

Q] Which are your areas of focus for cost-cutting? What are the urgent, immediate actions to be taken?

You don’t need a pandemic to eliminate waste; but the sense of purpose that a ‘black swan’ event like this throws up helps to focus better. We are a three-year-old business; we have not adopted a really bad spending habit. The immediate aftermath will be rejigging the productivity expectation from every resource deployed by the business - be it manpower, lease space, software-hardware, habituated or entrenched practice and such others.

Q] How has your role as CFO transitioned in this uncertain landscape?

To me, there is no question of a role transition, as the role of the CFO is akin to the role of an ace goal-keeper in a game of soccer. In an evenly matched game, especially one that extends to a penalty shot out, the goalkeeper’s ‘on-the-fly’ responses make for a winner or a loser. COVID-19 will quite simply challenge the cash-flow management ethos; and managing that is the fundamental reason why a CFO exists. Managing the inflow/outflow mismatch in an unpredictable environment is as intuitive as the expert goal-keeper’s prediction on which way the ball will travel! Bottomline, there will be no preparation time and intuition comes to play. For the CFO, it means real-time interaction with the business teams to address the mismatch between the earning side and spending side, ensuring that the organization sets out its outlays wisely, enables the business to take financially viable funding calls and most of all to keep the business well informed.

Q] How do you see this crisis playing out for businesses in the media industry in future?

In general, healthcare and public hygiene should get a lot more focus and our travel preferences and eating habits will change in a big way. Businesses in those sectors should ramp-up very rapidly. For media houses, the vulnerability of the advertisement-driven model will call for appropriate ring-fencing measures. Newspapers will find it hard to sustain their advertisement-skewed business model, now that the habit is broken and the right of way to the ‘bedroom’ that a newspaper enjoyed is seriously displaced. The Digital space will see traction and rapid growth, but what will be the financial model in that space is the moot question that eludes a definitive answer today. Finally, I hope that the true viewer interest in TV news will not only sustain, but will also get reflected by way of true and fair viewership and market-share even post COVID-19.

‘I HAVE BEEN ABLE TO CUT THE REQUIREMENT OF LIQUIDITY, AND ALSO AUGMENT LIQUIDITY’

R K Agarwal, CFO, Jagran Prakashan, says that the company is trying to reduce 50% of fixed cost to compensate for the drop in revenue owing to the COVID-19 situation

Q] How deep has been the impact of COVID-19 on your annual financial plan? And what are the changes you’ve made in terms of strategy?

Print, Television, Radio and Digital are still getting some advertisement avenue. Among these, TV and Print are slightly less affected as they get significant revenue from subscription as well.

Print, Television, Radio and Digital are still getting some advertisement avenue. Among these, TV and Print are slightly less affected as they get significant revenue from subscription as well.

There have been problems in distribution of newspapers in Mumbai and even now, the circulation has not normalized. But the circulation which had dropped by nearly 15-20% in other parts of the country has started recovering and reached a level of about 75% to 80%. We will get back to the original level of circulation in a short time. Print will also gain from its credibility which has been realized in a big way during this period.

Our sense is that Print revenue will go down in the range of 20-25%, if the lockdown comes off sooner than later, say May-end. TV is also expected to de-grow. According to experts, the entire media and entertainment industry should contract by 12-13% for the year 2021 on an overall basis. Within that, entertainment will suffer more than the media. If we come out of lockdown by May-end or by mid-June, and things start becoming normal in the next three to four months, then Print and Radio will both report profits and recover losses of H1.

Q] What are the key factors that will help recover these losses?

Drop in revenue will be significantly compensated by the savings in newsprint cost, which is more than 50% of the Print industry’s total cost. This saving is going to come through moderated newsprint prices and also cutting the pages for copy. These two will result in significant savings and compensate at least 60-65% of the loss of revenue.

Another important point is that the media and entertainment industry is largely a fixed cost-based business model. Within this, Print has less fixed cost as compared to other platforms such as TV, Radio. The variable cost in case of Print is the newsprint cost. The industry in general and Jagran Prakashan in particular is trying to reduce the balance 50% of fixed cost. Jagran has been known to be very conservative and adjusting to the changing circumstances much faster than any other player in the industry. We are aiming to save about 8% to 10% fixed cost. But this is not coming at the cost of staff. Jagran Group has assured every employee that their job is secure and salary intact unless circumstances become worse.

Q] How has your role as CFO changed?

My role as CFO has been two-directional. Number one is cutting the requirement of liquidity and the other direction is augmenting liquidity. In both directions, I have been able to get the desired result.

Q] By reducing liquidity, do you mean working on the newsprint cost, which is variable?

Not only newsprint cost, but also other fixed and operational costs. I collaborated with our operations team and put systems in place to bring in more efficiencies and cut costs in that area. Secondly, when we started, we had about Rs 300 crore of liquidity but I still targeted that the liquidity should go up rather than coming down. Hence, in order to augment more liquidity, we issued Non-Convertible Debentures (NCDs) worth Rs 250 crore and the money is parked in the bank as a contingent resource. Like never before, we have realised that liquidity is king.

CFO MOVES IN BRANDSPACE

- e-commerce giant Flipkart announced the appointment of Sriram Venkatraman as CFO for Flipkart Commerce which includes Flipkart and Myntra.

- Tiger Global-backed Games24X7 also appointed its first CFO- Rahul Tewari.

- Public lender State Bank of India (SBI) appointed Chalasani Venkat Nageswar as its new CFO

- Schneider Electric Infrastructure, which manufactures, designs and services advanced electricity products, promoted an internal candidate, Mayank Holani, to the CFO role.

- Many others, like VIP Industries, ASAL, NRB Bearings, too have new CFOs

THE CRISIS CHECKLIST

Chetan Borkar, CFO, Madison World shares a checklist on how CFOs can take on these difficult times head-on.

- The need of the hour is to:

- Conserve cash: Cash will be king and the corporates with cash in their coffers will be the kings when it comes to negotiation on future deals.

- Renegotiate debt and try and seek moratoriums: It’s best to meet bankers and renegotiate repayment schedules seeking moratorium on EMI without impacting interest costs.

- Relook at organisational structures and eliminate flab: A dire need to now relook at people requirements afresh, given the drop in revenues and evaluate the structure needed to service the reduced demand.

- Revising compensation structure and delaying increments: A temporary downward cut in compensations is inexorable. It’s better to retain trained talent rather than resorting to knee jerk reactions (pink slips) for short term gains.

- Eliminate discretionary spending: All discretionary spending like conferences, travel, training, entertainment and welfare costs will need a re-think.

- Continue WFH for a further period: It will help us manage social distancing as well as cut down on costs, or should it be the new normal is the question.

- Renegotiate fixed costs: Renegotiate all lease agreements with landlords and relook at work space requirements afresh.

- Hold on to Capex decisions: Revisit your immediate Capex plans and expend only what’s extremely important that’s impacting productivity. Also, look at leasing options for the interim.